- Antibiotics Tests in Milk

- Inhibitory detection test

- Laboratory equipment

- Centrifuges

- Indicator strips

- Autoclaves

- Scales

- Thermometers

- Packing

- PureTrust ATP monitoring

- ATP monitoring PIONEERPRODUKT CleanTrust

- MICROFAST® substrates

- Nutrient media

- Ice cream sticks

- Consumables

- Detergents and disinfectants

- Treatment agent

- Milk filters

- Wipes

- Gloves

- Sampling

McKinsey Analysts Call Pandemic 'End of an Era' for Banks

During the pandemic - from February 2020 to October 2021 - financial companies, including participants in the payment, investment and exchange markets, ensured an increase in the market capitalization of the global financial sector by almost $1 trillion, overtaking universal banks, according to a study by McKinsey analysts, received in RBC. We are talking about players who specialize in payments, exchange transactions and securities transactions without banking licenses.

Analysts of the consulting company note that the covid-19 pandemic marked the “end of an era” for banks: after the financial crisis of 2008, which affected the banking sector specifically, the “surviving” market participants increased reserves and capital under the new regulation, were able to survive the pressure of 2020, but faced a problem — digital transformation has accelerated and strengthened the market position of payment and fintech companies. “Most retail banks that take deposits and make loans have been left out,” McKinsey said in a survey.

PIONEER MEIZHENG BIO-TECH (5 in 1) JC0726 / Rapid tests for determining the residual amount of Bacitracin, ansamycins, clindamycin, spiramycin, florfenicol in milk, whey

PIONEER MEIZHENG BIO-TECH (5 in 1) JC0726 / Rapid tests for determining the residual amount of Bacitracin, ansamycins, clindamycin, spiramycin, florfenicol in milk, whey Rapid tests for determining the residual amount of tetracyclines in meat

Rapid tests for determining the residual amount of tetracyclines in meat Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey

Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey

PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey- Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey

- ANTIBIOTICS / ELISA TESTS

- Rapid tests for fluoroquinolone, erythromycin, lincomycin, tillosin and tilmycosin residues in milk, whey

- Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones

HI 98509 Checktemp 1 Portable Electronic Thermometer with Remote Sensor

HI 98509 Checktemp 1 Portable Electronic Thermometer with Remote Sensor Milk quality analyzer "Laktan 1-4M" isp. Mini

Milk quality analyzer "Laktan 1-4M" isp. Mini Analyzer for somatic cell counting "Expert Somatos"

Analyzer for somatic cell counting "Expert Somatos" Bürkle SteriBag StandUp Sample Bags 400 ml, sterile, with inscription field

Bürkle SteriBag StandUp Sample Bags 400 ml, sterile, with inscription field General laboratory cabinets

General laboratory cabinets Mutovki for flasks and tanks (Russia)

Mutovki for flasks and tanks (Russia)- Analogue of the device Chizhova Elex-7

- Light colored glass bottle without a faucet

- Abbe refractometers Atago

- Tagler BVR-18 water-reducer bath (Russia)

- Scrubber "KELTRAN" (KELTRUN)

- Testo 103 folding thermometer

- Lumitester SMART Luminometer

- Navigator NV222 mastoprim weighing scale, (220 g, 0.01 g, external calibration)

- Indicator strips for the determination of neutralizing substances (soda and ammonia) in milk, 100 pcs.

Korreks for desserts

Korreks for desserts Parchment

Parchment GableTop aseptic packaging

GableTop aseptic packaging Skiving and Hemming Technology

Skiving and Hemming Technology Korreks for confectionery

Korreks for confectionery Cartons for milk and dairy products

Cartons for milk and dairy products- Laminating paper KH PACK®

- KH PACK® tartlet paper

- Plastic packaging for cakes and pastries

- Paper sacks

- Grease and barrier paper KH PACK®

- Cover

- Carton

- Ice cream chopsticks

- KH PACK® Straight Packing Paper

Petri dish 90 mm

Petri dish 90 mm Ice cream sticks Magnum (curly)

Ice cream sticks Magnum (curly) Wafer cup and cone

Wafer cup and cone J-Bottom technology

J-Bottom technology Ice cream sticks (with logo)

Ice cream sticks (with logo) Auxiliaries for sugar products

Auxiliaries for sugar products- Ice cream sticks Standard 114

- General purpose environment of SPC "Biocompass-S" (Uglich)

- Pepsin whey pork

- Ice cream sticks (round)

- Ice cream sticks Standard 93

Mug for milking the first streams of milk, lengthwise

Mug for milking the first streams of milk, lengthwise Latex gloves (long cuff with roller), (color blue, pack of 50 pieces)

Latex gloves (long cuff with roller), (color blue, pack of 50 pieces) Pump for artificial ventilation of the lungs

Pump for artificial ventilation of the lungs Forged pitchforks

Forged pitchforks Napkin reusable for wiping the udder

Napkin reusable for wiping the udder Non-returnable cup for udder treatment

Non-returnable cup for udder treatment- Disposable udder wipe (udder paper).

- Hoof bath

- Foam cup for udder treatment

- Plastic bracelet

- Alkaline detergent (20l / 24kg)

- Electric Cattle Driver

- Gas tailing cutter

- Anti-catfish milking rings

- Fall with a loop for cattle

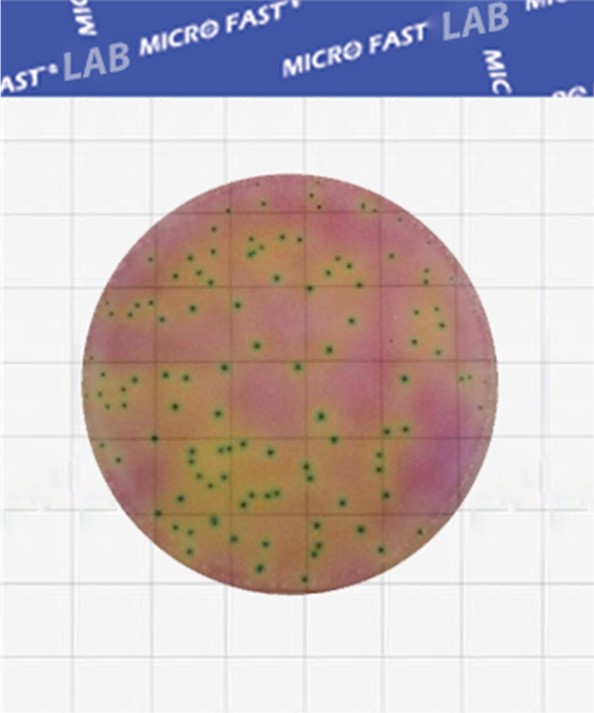

MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312)

MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312) MicroFast® Coliform & E.coli Count Plate

MicroFast® Coliform & E.coli Count Plate MicroFast® Environmental Listeria Count Plate

MicroFast® Environmental Listeria Count Plate Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate

Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate

Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate MicroFast® Microbiological Substrates

MicroFast® Microbiological Substrates- MicroFast® Staphyloccocus aureus Confirmation Plate Staph.aureus Confirmation Plate (cat. no. LR1005Q)

- MicroFast® Bacillus cereus Count Plate (catalog number LR1010)

- Substrate for determining QMAFAnM (catalog number LR1001)

- Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate

- MicroFast® Salmonella Count Plate (SAL), for the determination of Salmonella in food and environmental samples (Catalog #LR1006)

- MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011)

- Substrate for accelerated determination of QMAFAnM, (catalog number LR1321)

Лукашенко высказался против простых решений по Витебской области и действий по пути наименьшего сопротивления 25.10.2025

Лукашенко высказался против простых решений по Витебской области и действий по пути наименьшего сопротивления 25.10.2025 Производство молока, инвестиции. Какие точки роста на пятилетку видит руководство Витебской области25.10.2025

Производство молока, инвестиции. Какие точки роста на пятилетку видит руководство Витебской области25.10.2025 Первичная задача - дойти до каждого сельхозпредприятия. Депутат о развитии АПК Витебской области25.10.2025

Первичная задача - дойти до каждого сельхозпредприятия. Депутат о развитии АПК Витебской области25.10.2025- Совместные проекты и обмен опытом. В каких направлениях Беларусь и Казахстан готовы развивать сотрудничество в АПК 24.10.2025

- Беларусь и Алтайский край намерены увеличить биржевую торговлю сельхозпродукцией24.10.2025

- Минск и Алжир готовят переговоры на высшем уровне. Почему Беларусь нацелилась на Север Африки?24.10.2025

- "Ambitious plans." Brest Regional Executive Committee on the region's contribution to food security in the Union State. 23.10.2025

- Decree: Regional executive committees are granted the right to form agricultural raw material zones23.10.2025

- New support measure for the agricultural sector. The Ministry of Agriculture and Food explained the legislative changes.23.10.2025

- Recognition of merit and dedication. State awards were presented in Minsk to representatives of various fields.23.10.2025

- The Belarusian delegation held talks in Kampala with colleagues from Uganda, Iran, and India.17.10.2025

- Azerbaijan entered the top three largest buyers of forest products at the Belarusian Commodity Exchange (BUCE).17.10.2025

- New Products and Volume Growth. The Ministry of Agriculture and Food on the Dairy Industry Development Strategy through 2035.17.10.2025

- Ministry of Agriculture and Food: Belarus is growing its milk production16.10.2025

- Ambassador: Belarusian food exports to Kazakhstan have increased significantly16.10.2025

- Belarusian goods account for 94% of Russian dairy imports.16.10.2025

Сокращение супермаркетов и гипермаркетов в России продолжается: эксперты говорят о новой волне ритейла25.10.2025

Сокращение супермаркетов и гипермаркетов в России продолжается: эксперты говорят о новой волне ритейла25.10.2025 Парагвай: Экспорт субпродуктов является растущей отраслью и уже достиг 95,4 млн долларов США25.10.2025

Парагвай: Экспорт субпродуктов является растущей отраслью и уже достиг 95,4 млн долларов США25.10.2025 Китай увеличил производство свинины на 7% в третьем квартале года25.10.2025

Китай увеличил производство свинины на 7% в третьем квартале года25.10.2025- Новые горизонты сотрудничества: Россия и Аргентина обсуждают совместный доступ на рынки продукции животного происхождения25.10.2025

- Птицефабрика «Третьяковская» в Воронежской области удвоит производство яиц на 2 миллиарда рублей25.10.2025

- Indilight held a culinary masterclass with Silvena Rowe, promoting turkey as a healthy food.25.10.2025

- Министерство сельского хозяйства США представило план по снижению цен на говядину25.10.2025

- С января по июль экспорт свинины из ЕС вырос на 1,6%25.10.2025

- Рост цен на мясо в Самаре: говядина достигла 750 рублей за килограмм25.10.2025

- Московская область планирует нарастить мясное производство на 25% к 2030 году25.10.2025

- Производство мяса птицы в Омской области выросло на 75% за 9 месяцев 2025 года25.10.2025

- Цены на мясные продукты в России продолжают расти: анализ причин и прогнозы25.10.2025

- Product quality violations were discovered at the Pravilnye Produkty plant.23.10.2025

- Nalchik Meat Processing Plant Puts Its Accounts Receivable Up for Auction23.10.2025

- Modernization of poultry farming in the Nizhny Novgorod region: new opportunities and production growth23.10.2025

- Increasing egg production of laying hens in Kabardino-Balkaria: successes and prospects23.10.2025

10 reasons to take a deposit04.05.2025

10 reasons to take a deposit04.05.2025 NYT увидела в санкциях Трампа новый уровень экономической войны США25.10.2025

NYT увидела в санкциях Трампа новый уровень экономической войны США25.10.2025 В Кремле пообещали ответ на санкции сообразно интересам России25.10.2025

В Кремле пообещали ответ на санкции сообразно интересам России25.10.2025- Захарова пообещала «жесткие шаги» в ответ на 19-й пакет санкций ЕС25.10.2025

- США ввели санкции против президента Колумбии25.10.2025

- Чего ожидать от «одной из самых рискованных» поездок Трампа25.10.2025

- Callas spoke about the EU's joy over new US sanctions against Russia.24.10.2025

- Постпредство России назвало санкции ЕС «сизифовым трудом»24.10.2025

- Путин оценил новые санкции США24.10.2025

- Путин вспомнил, когда Трамп ввел наибольшее число санкций против России24.10.2025

- Белый дом заявил о надежде на то, что новые санкции нанесут вред России24.10.2025

- The EU imposed sanctions against Medvedev's aide and the HSE rector.23.10.2025

- Politico learned of a split in the EU over a new €140 billion loan to Ukraine.23.10.2025

- The European Union has banned the import of motorized toys into Russia.23.10.2025

- The Russian Union of Travel Industry (RUTI) clarified that EU sanctions will not affect Russian tourism.23.10.2025

- AvtoVAZ and Polyus were included in the 19th package of EU sanctions against Russia.23.10.2025

В Британии предупредили о риске для миллионов из-за супербактерий06.01.2025

В Британии предупредили о риске для миллионов из-за супербактерий06.01.2025 Moscow court sides with Indian company in dispute with Health Ministry26.11.2024

Moscow court sides with Indian company in dispute with Health Ministry26.11.2024 Scientists estimate increase in mortality due to drug-resistant bacteria29.10.2024

Scientists estimate increase in mortality due to drug-resistant bacteria29.10.2024- Antibiotics for livestock and pesticides found in poisoned family's home29.10.2024

- Izvestia reported on the shortage of widely used antibiotics in Russia29.10.2024

- The Ministry of Health called data on the shortage of antibiotics unreliable29.10.2024

- Scientists warn of threat of return to pre-penicillin times29.10.2024

- The Ministry of Health explained how attitudes towards antibiotics changed during the pandemic07.05.2024

- WHO explains the risks of taking antibiotics "just in case"06.05.2024

- Doctors warn of bad practices after government decision on antibiotics25.04.2024

- The Ministry of Health removed antibiotics and hormones from the standard treatment of ARVI25.04.2024

- Antibiotics in oil: myth or reality?06.03.2024

- Antibiotics in sour cream: myth or reality?05.03.2024

- Antibiotics in goat milk: effects, problems and control measures16.02.2024

- The Japanese will stop producing the popular antibiotic vilprafen in Russia23.12.2023

- Antibiotics in Milk21.12.2023

Antibiotics in pollock25.02.2024

Antibiotics in pollock25.02.2024 Antibiotics in herring: myth or reality?12.02.2024

Antibiotics in herring: myth or reality?12.02.2024 Antibiotics in perch10.02.2024

Antibiotics in perch10.02.2024- Antibiotics in sprat: facts and myths10.02.2024

- Antibiotics in tuna: an important health and environmental issue09.02.2024

- Antibiotics in meat30.01.2024

- Antibiotics in chebureks: myth or reality?29.01.2024

- Antibiotics in cutlets: problem or myth?18.01.2024

- Antibiotics in Chicken: Where Are the Highest Concentrations?17.01.2024

- Antibiotics in carp17.01.2024

- Where Are More Antibiotics in Chicken: Reality and Cautions16.01.2024

- Antibiotics in Salmon: Safety and Product Quality16.01.2024

- Antibiotics in Turkey15.01.2024

- Antibiotics in Sal: Reality and Safety Issues15.01.2024

- Antibiotics in Fried Dumplings: Facts, Risks and How to Stay Safe15.01.2024

- Antibiotics in sausages14.01.2024

Antibiotics in Coffee: Myths and Reality03.05.2025

Antibiotics in Coffee: Myths and Reality03.05.2025 Forged forks: 10 interesting facts16.05.2024

Forged forks: 10 interesting facts16.05.2024 Swimming pool and weight loss: 10 interesting facts10.03.2024

Swimming pool and weight loss: 10 interesting facts10.03.2024- Tests for antibiotics in milk - 10 interesting facts07.03.2024

- Cleaning the kettle from scale, 10 interesting facts...06.03.2024

- Antibiotics in beer: 10 interesting facts04.03.2024

- Wild boar, how to survive...01.03.2024

- Purulent mastitis, 10 interesting facts27.02.2024

- Lemon and alcohol: 10 interesting facts25.02.2024

- Mint - 10 interesting facts25.02.2024

- Wild boar, 10 interesting facts20.02.2024

- Wild boar and domestic pig: comparison and advantages20.02.2024

- Cottage cheese, 10 interesting facts20.02.2024

- 10 Interesting Facts About Milk19.02.2024

- How to Clean a Toilet - 10 Interesting Facts (Acid vs Alkaline)18.02.2024

- Goat's milk: 10 interesting facts16.02.2024

Dicroceliosis in cattle09.03.2024

Dicroceliosis in cattle09.03.2024 Demodicosis in cattle01.03.2024

Demodicosis in cattle01.03.2024 Purulent mastitis of cattle27.02.2024

Purulent mastitis of cattle27.02.2024- Hypodermatosis in cattle20.02.2024

- Hemonchoz in cattle11.02.2024

- Bursitis in cattle30.01.2024

- Brucellosis in cattle29.01.2024

- Bronchopneumonia in calves27.01.2024

- Bronchitis in cattle26.01.2024

- Mortellaro disease in cattle24.01.2024

- White muscle disease in cattle23.01.2024

- Babesiosis in cattle22.01.2024

- Cattle acidosis20.01.2024

- Arthritis in cattle20.01.2024

- Anaplasmosis in cattle18.01.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024 В Минтруда напомнили об основных мерах безопасности во время проведения республиканского субботника 25.10.2025

В Минтруда напомнили об основных мерах безопасности во время проведения республиканского субботника 25.10.2025 In Minsk, an unlicensed BMW driver lost control and crashed into a pole.25.10.2025

In Minsk, an unlicensed BMW driver lost control and crashed into a pole.25.10.2025- В Вилейском районе правоохранители застали самогонщиков с поличным: выявлено 11 тыс. литров браги25.10.2025

- Забрал пенсию и кормил раз в 2-3 дня. В Витебске сын довел мать-инвалида до истощения25.10.2025

- В Беларуси с начала года в авариях пострадали 340 детей24.10.2025

- МВД: реальные истории осужденных сверстников - эффективная профилактика преступлений подростков 24.10.2025

- Минчанин осужден за истязание беременной сожительницы24.10.2025

- A drunk Pinsk resident stole a car and damaged parked vehicles.23.10.2025

- The Ministry of Emergency Situations will hold the "For Safety Together" campaign in Belarus from October 25 to November 2.23.10.2025

- This swimming season, 44 fishermen have drowned in Belarus, 25 of whom were drunk. 23.10.2025

- A drunk teenager stole a car in Bobruisk. 23.10.2025

- "A House Without Fire": Rescuers Inspect Homes in the Gorki District 23.10.2025

- She'll still be in your dreams! A Belarusian woman visited Karelia, and here's what she had to say.18.10.2025

- They "worked" for less than a month. A young drug couple from Mozyr was taken into custody.18.10.2025

- Ten ppm: A man died of acute alcohol poisoning in Volkovysk.18.10.2025

Persons

Our Partners

Top 10

Our Test - Pioneer Tests

- Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

- TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

- PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey