- Antibiotics Tests in Milk

- Inhibitory detection test

- Laboratory equipment

- Centrifuges

- Indicator strips

- Autoclaves

- Scales

- Thermometers

- Packing

- PureTrust ATP monitoring

- ATP monitoring PIONEERPRODUKT CleanTrust

- MICROFAST® substrates

- Nutrient media

- Ice cream sticks

- Consumables

- Detergents and disinfectants

- Treatment agent

- Milk filters

- Wipes

- Gloves

- Sampling

The Chinese authorities will buy a "golden share" in bigtech. Why it's good for stocks

In the ongoing confrontation between the authorities and the Chinese technology sector, a new round has been outlined: Chinese government structures are preparing to acquire "golden shares" in the subdivisions of Alibaba Group and Tencent Holdings in order to gain greater control over key players in the Chinese it market.

The easing of pressure on China's private companies, along with the expected end of the draconian "zero tolerance" policy for covid-19, are meant to support the country's slowing economy and its stock market.

Owning a stake in a company, often as little as 1%, theoretically allows the government to appoint directors or influence key decisions of the company and can give officials a tool to influence the industry in the long run. In CHINA, this mechanism is known as “special management shares” and has been used since 2015 as a tool for state control over business.

The problems of the Chinese technology sector began in 2021 - then the regulators stopped the preparation of the IPO of Ant Group, the financial division of Alibaba. Some time before, the founder of the company, Jack Ma, spoke critically of the Chinese authorities - it was then that the departments paid close attention to technology companies and their founders.

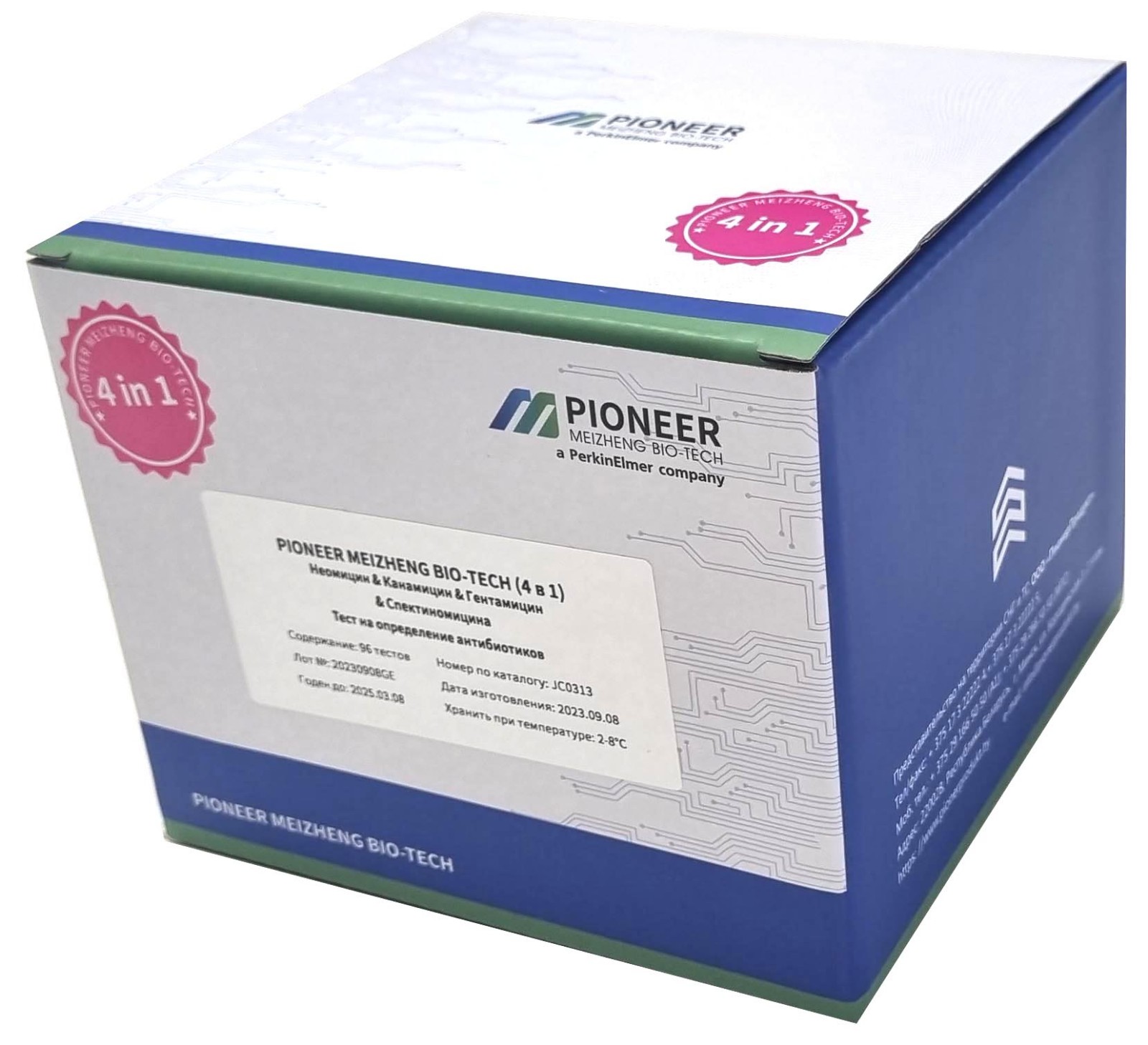

Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey

Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey. Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey PIONEER MEIZHENG BIO-TECH (5 in 1) JC0726 / Rapid tests for determining the residual amount of Bacitracin, ansamycins, clindamycin, spiramycin, florfenicol in milk, whey

PIONEER MEIZHENG BIO-TECH (5 in 1) JC0726 / Rapid tests for determining the residual amount of Bacitracin, ansamycins, clindamycin, spiramycin, florfenicol in milk, whey

Laboratory heating plate PL-01

Laboratory heating plate PL-01 Exhaust cabinets

Exhaust cabinets Areometer AON - 1 (set of 19)

Areometer AON - 1 (set of 19) Magnetic stirrer with heating function WH240-HT

Magnetic stirrer with heating function WH240-HT Laboratory thermostat-reductor LTR

Laboratory thermostat-reductor LTR Milligram weights

Milligram weights- Analyzer of somatic cells in milk "SOMATOS Mini"

- Indicator strips "CHAS-100 mg",100 pcs

- Bürkle Qualirod tapered sampler 120 and 170 mm immersion depth

- Thermohygrometer IVA-6AR (Russia)

- Stationary pH meter/millivolt meter/thermometer (pH/mV/ORP/T) Edge HI 2202-01

- Smooth micrometers MK

- Navigator NV222 mastoprim weighing scale, (220 g, 0.01 g, external calibration)

- RT5 Multi-Magnetic Stirrer with Heating, IKA

- pH electrodes Hanna Instruments (Germany)

Cartons for milk and dairy products

Cartons for milk and dairy products Ice cream sticks Magnum (curly)

Ice cream sticks Magnum (curly) Pepsin whey pork

Pepsin whey pork GableTop aseptic packaging

GableTop aseptic packaging Auxiliaries for sugar products

Auxiliaries for sugar products Ice cream sticks (with logo)

Ice cream sticks (with logo)- Ice cream sticks (round)

- Ice cream sticks Standard 93

- J-Bottom technology

- Wafer cup and cone

- Petri dish 90 mm

- General purpose environment of SPC "Biocompass-S" (Uglich)

- Ice cream sticks Standard 114

MicroFast® Microbiological Substrates

MicroFast® Microbiological Substrates MicroFast® Staphyloccocus aureus Confirmation Plate Staph.aureus Confirmation Plate (cat. no. LR1005Q)

MicroFast® Staphyloccocus aureus Confirmation Plate Staph.aureus Confirmation Plate (cat. no. LR1005Q) Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate

Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate

Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate MicroFast® Coliform & E.coli Count Plate

MicroFast® Coliform & E.coli Count Plate MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312)

MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312)- MicroFast® Salmonella Count Plate (SAL), for the determination of Salmonella in food and environmental samples (Catalog #LR1006)

- MicroFast® Bacillus cereus Count Plate (catalog number LR1010)

- Substrate for determining QMAFAnM (catalog number LR1001)

- MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011)

- MicroFast® Environmental Listeria Count Plate

- Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate

- Substrate for accelerated determination of QMAFAnM, (catalog number LR1321)

Robotics and space systems: what developments did Belarus present at the Forum of Regions27.06.2025

Robotics and space systems: what developments did Belarus present at the Forum of Regions27.06.2025 The National Bank is launching the "New Champions" project to develop small and medium businesses27.06.2025

The National Bank is launching the "New Champions" project to develop small and medium businesses27.06.2025 Какие преференции даст странам ЕАЭС торговое соглашение с ОАЭ, рассказал эксперт27.06.2025

Какие преференции даст странам ЕАЭС торговое соглашение с ОАЭ, рассказал эксперт27.06.2025- Fine cheeses and drinks with a history. How an agrotown in the Myadel district became a center of industrial tourism.27.06.2025

- MFA: Belarus can make a serious contribution to ensuring food security in Mongolia26.06.2025

- Belarus and Cuba have identified promising growth points in trade. Lukashenko has announced the details 25.06.2025

- Беларусь на 10% увеличила биржевой товарооборот со странами ЕАЭС23.06.2025

- Farm Workshop, Summit Prep, Distinguished Alumni, and Trump's Special Envoy: President's Week in Review22.06.2025

- АПК, промышленность, туризм. Гомельская область на ПМЭФ обсуждает развитие партнерства с регионами России20.06.2025

- For several years they have been the first in the region. We asked the director of OAO Dembrovo what the secret of the enterprise's success is 20.06.2025

- Упрочить стабильность. МАРТ объяснил необходимость контроля цен на мясо, молоко и сладости20.06.2025

- Правительство взяло на особый контроль ценообразование на мясо-молочную продукцию и кондитерские изделия 20.06.2025

- "It's cooler than space!" How BNBC turns a grain of wheat into proteins essential for humans19.06.2025

- Что стоит за принятием взвешенных управленческих решений на предприятиях, рассказала Медведева19.06.2025

- Кексы с капустой: оригинальная выпечка для любого повода18.06.2025

- Предприятия Гомельской области в 1,7 раза нарастили экспорт в Россию через БУТБ18.06.2025

Перспективные тренды кадрового обеспечения агропромышленного комплекса17.09.2025

Перспективные тренды кадрового обеспечения агропромышленного комплекса17.09.2025 Россия извлекает выгоду из торговых противоречий между Китаем и Западом17.09.2025

Россия извлекает выгоду из торговых противоречий между Китаем и Западом17.09.2025 Увеличение экспорта свинины России: новые горизонты на зарубежных рынках17.09.2025

Увеличение экспорта свинины России: новые горизонты на зарубежных рынках17.09.2025- Construction of a full-cycle poultry farm worth 13.3 billion rubles to begin in Khabarovsk17.09.2025

- Russia's largest rabbit-catching complex supplies the Smolensk region with high-quality meat.17.09.2025

- США сохранят запрет на экспорт крупного рогатого скота из Мексики до 2026 года17.09.2025

- США подтвердили наличие высокопатогенного птичьего гриппа в молочном стаде в Небраске17.09.2025

- Uruguay Changes Meat Market: What Argentina Can Learn17.09.2025

- Аргентина: Правительство определяет новую стратегию вакцинации против ящура17.09.2025

- Center-Reserve launches full-cycle meat production in the Stavropol region17.09.2025

- Crimea boosts milk and meat production by developing elite cattle breeding17.09.2025

- Первая партия голштинских бычков экспортирована в Таджикистан17.09.2025

- Перспективы отечественного рынка говядины остаются позитивными, несмотря на снижение поголовья17.09.2025

- Ростовская область экспортировала 148 тонн мяса птицы за первые дни сентября17.09.2025

- Неожиданные добавки в пельменях: производитель оштрафован в Красноярском крае17.09.2025

- Chicken prices in Russia: average level reaches 354 rubles per kilogram17.09.2025

ЕС перед встречей Путина и Трампа пообещал новые санкции против России14.08.2025

ЕС перед встречей Путина и Трампа пообещал новые санкции против России14.08.2025 «Евротройка» заявила ООН о готовности вернуть санкции против Ирана14.08.2025

«Евротройка» заявила ООН о готовности вернуть санкции против Ирана14.08.2025 SCMP узнала о застрявших из-за санкций в России китайских самолетах14.08.2025

SCMP узнала о застрявших из-за санкций в России китайских самолетах14.08.2025- Китай ввел ответные санкции против двух банков Евросоюза14.08.2025

- Россиянам под санкциями разрешили въезд на Аляску для участия в саммите14.08.2025

- Китай ответил на угрозы Трампа о новых пошлинах из-за российской нефти09.08.2025

- Trump answered a question about the timing of the introduction of anti-Russian sanctions08.08.2025

- Foreign Policy identified a group of D7 countries with the risk of “domino devaluations”07.08.2025

- FT finds out what outcome of Whitkoff's visit to Russia will "infuriate" Trump06.08.2025

- Reuters finds out how the Kremlin assessed Trump's ultimatum06.08.2025

- Зеленский заявил о «продуктивном» разговоре с Трампом о санкциях и России06.08.2025

- FT узнала о «легком первом шаге» США в расширении санкций против России06.08.2025

- Trump says he will decide on sanctions after Russia-US meeting06.08.2025

- Демократы обвинили Трампа в ослаблении санкций против России06.08.2025

- Zelensky announces sanctions against captains of Russian shadow fleet05.08.2025

- Trump reveals what will happen after his ultimatum expires05.08.2025

Antibiotics: harm or benefit17.07.2019

Antibiotics: harm or benefit17.07.2019 Antibiotics in milk16.07.2019

Antibiotics in milk16.07.2019

Antibiotics in Meat: Prevention, Regulation and Consumer Health Concerns12.01.2024

Antibiotics in Meat: Prevention, Regulation and Consumer Health Concerns12.01.2024 Antibiotics in Fried or Boiled Meat: Facts and Misconceptions12.01.2024

Antibiotics in Fried or Boiled Meat: Facts and Misconceptions12.01.2024 Antibiotics in Sausage: Reality, Risks and Need for Control12.01.2024

Antibiotics in Sausage: Reality, Risks and Need for Control12.01.2024- Antibiotics in Pelmeni: Real Threat or Myth?09.01.2024

- Antibiotics in Pork: Health Effects and Cooking Recommendations08.01.2024

- Antibiotics in Chicken: Safety, Regulation and Consumer Health Concerns08.01.2024

- Antibiotics in meat: problems and solutions06.01.2024

- Antibiotics in Beef: Between Animal Health and Consumer Safety06.01.2024

- Antibiotics in Chicken Meat: Safety, Regulation and Concern for Consumer Health06.01.2024

- Antibiotics in Rabbit Meat: Safety, Efficiency and Care for Consumers05.01.2024

- Antibiotics in Pork: Balance Between Health Concerns and Consumer Safety03.01.2024

- Antibiotics in Lamb03.01.2024

- Antibiotics in Meat: Real Risks and Transparency in Food Production29.12.2023

Marbled meat: 10 interesting facts19.01.2024

Marbled meat: 10 interesting facts19.01.2024 10 Fascinating Facts About Cattle Hoof Baths18.01.2024

10 Fascinating Facts About Cattle Hoof Baths18.01.2024 Antibiotics - 10 interesting facts18.01.2024

Antibiotics - 10 interesting facts18.01.2024- Cutlets - 10 interesting facts18.01.2024

- 10 Interesting Facts about Carp17.01.2024

- Salmon - 10 Interesting Facts17.01.2024

- Beer belly 10 interesting facts17.01.2024

- Beer - 10 interesting facts17.01.2024

- Antibiotic tests pioneer - 10 interesting facts17.01.2024

- Rubber rings for castration - 10 interesting facts17.01.2024

Dicroceliosis in cattle09.03.2024

Dicroceliosis in cattle09.03.2024 Demodicosis in cattle01.03.2024

Demodicosis in cattle01.03.2024 Purulent mastitis of cattle27.02.2024

Purulent mastitis of cattle27.02.2024- Hypodermatosis in cattle20.02.2024

- Hemonchoz in cattle11.02.2024

- Bursitis in cattle30.01.2024

- Brucellosis in cattle29.01.2024

- Bronchopneumonia in calves27.01.2024

- Bronchitis in cattle26.01.2024

- Mortellaro disease in cattle24.01.2024

- White muscle disease in cattle23.01.2024

- Babesiosis in cattle22.01.2024

- Cattle acidosis20.01.2024

- Arthritis in cattle20.01.2024

- Anaplasmosis in cattle18.01.2024

В Витебской области за выходные задержано 25 бесправников14.07.2025

В Витебской области за выходные задержано 25 бесправников14.07.2025 Drunk woman driving causes accident in Minsk 14.07.2025

Drunk woman driving causes accident in Minsk 14.07.2025 One got tired of walking and stole a bicycle, the other stole two to pawn. Both were detained13.07.2025

One got tired of walking and stole a bicycle, the other stole two to pawn. Both were detained13.07.2025- Мужчину спасли на Комсомольском озере в Минске 13.07.2025

- Mom gave me the keys. A 17-year-old motorcyclist without a license was detained in Brest district12.07.2025

- Женщина умерла от передозировки мефедроном в Кобринском районе. Возбуждены уголовные дела10.07.2025

- C 1 октября расширяется перечень товаров, подлежащих прослеживаемости10.07.2025

- В Румынии предупредили о возможном подорожании хлеба в два раза09.07.2025

- Убил мать с особой жестокостью. В Гомеле вынесли приговор жителю Петриковского района09.07.2025

- Пьяного бесправника с преследованием задержали в Гродно09.07.2025

- В Гродненской области два человека пострадали от укусов гадюки09.07.2025

- A drunk driver caused an accident in one of the courtyards of Gomel. The traffic police reported on the results of the "drunk" maneuver09.07.2025

- Consequences of heat. Since July 3, 10 children and 18 adults have sought medical attention for heat strokes08.07.2025

- Какие недостатки выявлены на детских площадках, рассказали в прокуратуре Берестовицкого района08.07.2025

- Минчанин обвинил свою гостью в краже и убил ее. СК раскрыл подробности расследования08.07.2025

- "Политико-отпускной бедлам". Шмидт о подоплеке последних событий в Польше07.07.2025

Persons

Our Partners

Top 10

Our Test - Pioneer Tests

- Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

- TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

- PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey