Russians ate a record amount of meat in 2022

Meat consumption in RUSSIA in 2022 increased by 2.3% compared to 2021 and reached a record high for at least the last ten years - 79 kg per person per year. This follows from the presentation of the National Union of Pig Breeders at the February 10 session of the International Conference of Agricultural Producers “Where is the Margin 2023” (the document is at the disposal of RBC).

The record provided an increase in the two main types of meat in the basket of consumers - pork and poultry meat, follows from the presentation. Pork consumption increased most noticeably - by almost 5.9% compared to the previous year, to 29.8 kg per person per year. The figure was a record over the past 30 years, noted in the National Union of Pig Breeders, and the share of pork in total consumption reached 37.5%.

The largest share of consumption (44.3%) is still accounted for by poultry meat - its average Russian ate about 35 kg in 2022. The consumption of this type of meat also increased, but not at the same pace as pork: the increase in this segment was 2% compared to 2021. Consumption of beef and mutton fell last year (by 1.9 and 7.1% respectively).

The Ministry of Finance ruled out the introduction of a tax on meat in Russia Economics

Why they began to eat more pork

The main reason for the growing popularity of pork among Russians is that the increase in prices for it in 2022 was lower than for other types of meat, primarily poultry, Yury Kovalev, general DIRECTOR of the National Union of Pig Breeders, explained during a speech at the conference. According to him, wholesale prices for pig products decreased by 5-7% on average over the year, while retail prices showed “no growth”. According to Rosstat, in December 2022, pork in Russian stores was on average slightly cheaper than in the same month a year ago: boneless meat was 1.1% cheaper (395.7 rubles per 1 kg), and meat on the bones fell in price by 1.3% (up to 307.9 rubles per 1 kg).

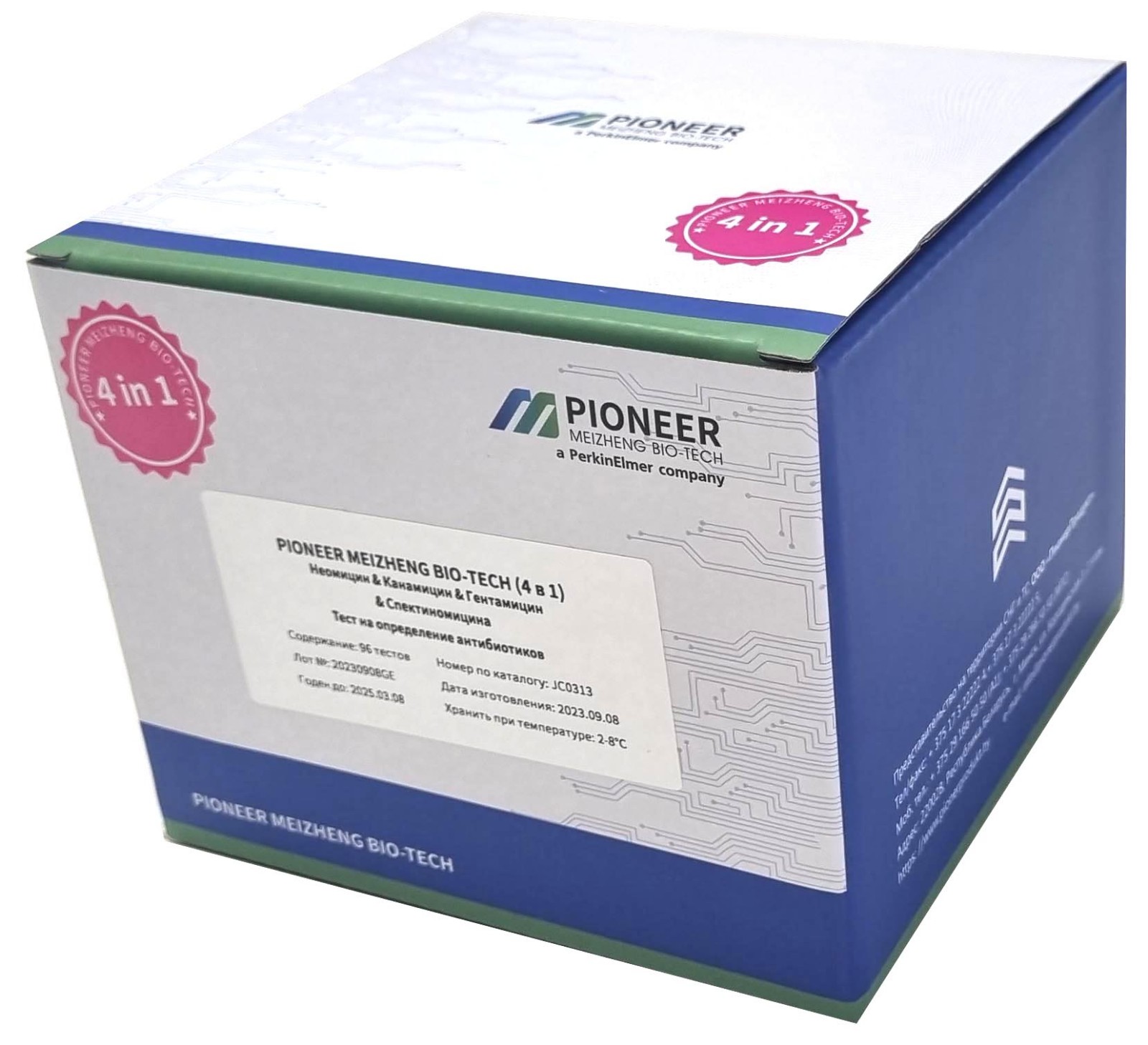

Read pioneerprodukt.by Look inside yourself: do you need an audit of your life and what to do for this The Fed has slowed down the pace of rate hikes.What awaits the markets and the economy How to register foreign remote workers without violating the lawAnother factor that influenced consumption is the program of state assistance to the poor: we are talking about 0.5 trillion rubles allocated in 2022 to support those in need, and 0.5 trillion rubles. increased indexation of wages for state employees, noted the National Union of Pig Breeders. Additional funds received from the state made pork more affordable for consumers: “This did not affect the consumption of wealthy and middle-class people, and for low-income citizens, a significant part of this money went to food, in particular pork, which became cheaper. As a result, a large number of low-income families, who previously could not afford this meat or could afford a little, began to buy it,” Kovalev noted.

FAS started anti-cartel check of Miratorg Business

The decline in prices switched the demand for pork from other types of meat - more expensive beef, as well as poultry meat. “The period of market saturation has led to the fact that the difference between the price of poultry and pork has significantly decreased. If in general for the last 15 years the difference in price was 50%, then at the end of last year this difference was 20-25%,” said the director general of the National Union of Pig Breeders.

Why pork prices are falling

In recent years, pork production in Russia has increased markedly. In 2012, the country was a major importer, but in six years, by 2018, Russia managed to achieve 100% self-sufficiency in the production of this type of meat, the presentation notes. One of the reasons for the development of this segment of the meat market was state support - soft loans for projects for the construction of new pig farms, which were issued until the end of 2018. At the end of 2018, the top 20 largest pork producers took out investment loans for 250 billion rubles, which during 2020–2024 will ensure an increase in industrial pig production by 5–10%, the National Union of Pig Breeders notes.

Who are the largest pork producers in Russia

The market leader, according to the National Union of Pig Breeders, is the agricultural holding Miratorg, which accounts for about 12.6% of the total industrial pork production in Russia. In 2022, the company produced 665 thousand tons of pork for slaughter in live weight. The three largest producers also include Sibagro JSC and the Rusagro group - they account for 7.4 and 6.4% of production, respectively (388 thousand and 336.1 thousand tons).

The President of Miratorg called on the authorities to continue the "regulatory guillotine" Business

In 2022, pork production in Russia amounted to 5.8 million tons, an increase of 5% compared to the previous year. The main part of production falls on the industrial sector: last year, agricultural holdings and other agricultural enterprises produced 5.3 million tons of pork (7% more than a year earlier). In peasant and farm enterprises, as well as personal subsidiary farms, production, on the contrary, fell by 14.9 and 10.2%, respectively.

Along with the increase in production, EXPORT opportunities for Russian pig farmers are limited. “In those countries that are open to us, we have already reached the maximum of opportunities,” Kovalev explains, adding that in 2021-2022, exports amounted to about 5% of production. At the end of 2022, the total export of pig products amounted to 173 thousand tons.

At the beginning of 2022, the HEAD of Miratorg, Viktor Linnik, warned that against the backdrop of rising costs and state regulation of the agricultural sector in Russia, for the first time in 15 years, meat production projects stopped paying off. The state has been subsidizing a lot in pork production, many farms have been built, and “no new investment in pork is paying off,” Rusagro CEO Timur Lipatov agreed at the end of last year.

Head of Rusagro - RBC:“We will fight to the last for each shareholder” Business

The National Union of Pig Breeders predicts a further decline in pork prices. This will be affected, in particular, by a decrease in production costs against the backdrop of a strengthening ruble and cheaper grain as a result of a record harvest: the estimated average production cost (excluding depreciation and financial costs) per 1 kg of pork live weight in 2022 is within 85 rubles. , while taking into account the current situation in the grain market in 2023, it may drop to 75-80 rubles. for 1 kg.

According to Rosstat, in January 2023, retail pork prices continued to decline both compared to the previous month and relative to January 2022 - the decrease was about 0.9% (to 394.3 rubles per 1 kg for boneless meat and to 306 4 rubles per 1 kg for meat on the bone).

The Ministry of Agriculture clarified that due to the increase in production, selling prices for pork are now below the level for the same period last year. According to the ministry, as of February 8, producer prices fell by 7.3% year-on-year.

“At the same time, the industry maintains marginality. This was also due to a record grain harvest last year and a decrease in feed prices,” the Ministry of Agriculture noted, adding that in order to expand sales opportunities, the ministry is constantly working to develop exports and open new foreign markets.

RBC sent a request to Miratorg and Rusagro.