- Antibiotics Tests in Milk

- Inhibitory detection test

- Laboratory equipment

- Centrifuges

- Indicator strips

- Autoclaves

- Scales

- Thermometers

- Packing

- PureTrust ATP monitoring

- ATP monitoring PIONEERPRODUKT CleanTrust

- MICROFAST® substrates

- Nutrient media

- Ice cream sticks

- Consumables

- Detergents and disinfectants

- Treatment agent

- Milk filters

- Wipes

- Gloves

- Sampling

Growing, but there are nuances: what you need to know about the Indian stock market

In 2022, growth was observed only in a few equity markets. Commodity-exporting countries such as Brazil, Indonesia and the Gulf States, which have benefited from energy shortages, have fared well on the stock exchanges. But there is also an unusual case: India. At the end of November, the Indian stock market indices NIFTY 50 and SENSEX hit record highs. Over the past year, shares of Indian companies have grown by 4% in local currency. And this despite the fact that, on average, the world's securities of companies traded on the stock exchange fell by 20%.

All this may mean that the Indian market has prospects. Investors are reconsidering their positions in the largest emerging market - CHINA. Despite the fact that the country's stock market reacted positively to the news about the easing of the "zero tolerance" policy for covid-19 , the MSCI China index has decreased by a quarter since the beginning of 2020. As a result, its average annual return has fallen below 1% over the past decade. Many managers see India as a more attractive place to diversify their assets.

However, the Indian stock market has its own problems that make it a less likely safe haven candidate.

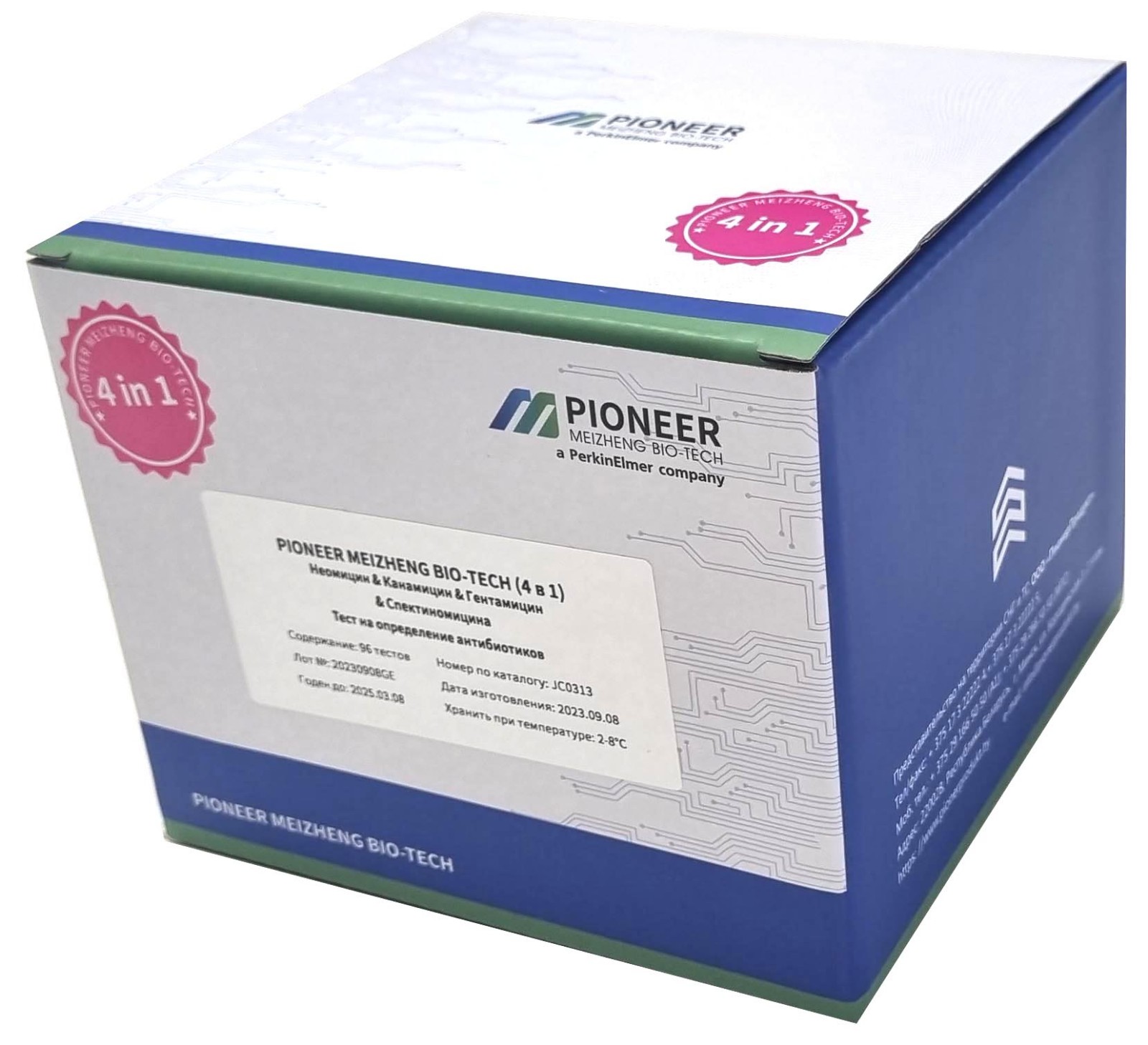

Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey

Rapid 4 in 1 tests for determining the residual amount of neomycin, kanamycin, gentamicin, spectinomycin in milk, whey TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040

TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040 Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey

Express tests for determining the residual amount of β-lactams and tetracyclines in milk, whey Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides

Express-tests PIONER 5 in1 for the determination of thiamphenicol, meloxicam, colistine, trimethoprim, sulfonamides Rapid tests for determining the residual amount of tetracyclines in meat

Rapid tests for determining the residual amount of tetracyclines in meat- Rapid tests PIONER 5 in 1 for the determination of sulfonamides, tylosin, tilmicosin, lincomycin, erythromycin, fluoroquinolones

- Rapid tests for determining the residual amount of chloramphenicol in meat

- PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

Low island table with drawers BA-CL-X.Х.Х Son-ya TR

Low island table with drawers BA-CL-X.Х.Х Son-ya TR Tagler TSLM 1-8 milk centrifuge (without heating) (Russia)

Tagler TSLM 1-8 milk centrifuge (without heating) (Russia) Laboratory table on supporting pedestal BA-CL-X.X SLv-t TR -a

Laboratory table on supporting pedestal BA-CL-X.X SLv-t TR -a Abbe refractometers Atago

Abbe refractometers Atago Steam autoclaves/sterilizers GC (Russia)

Steam autoclaves/sterilizers GC (Russia) Stationary pH meter/millivoltmeter/thermometer (pH/mV/T) Edge HI 2002-02 with pH electrode HI 11310

Stationary pH meter/millivoltmeter/thermometer (pH/mV/T) Edge HI 2002-02 with pH electrode HI 11310- Manual homogenizer D-130 with tripod

- Nova Safety milk centrifuge (Germany)

- Mastic Milk Indicator Strips, 100 pcs

- Indicator strips "Total water hardness", 25 pcs.

- Laboratory blender Waring (USA)

- Navigator NV222 mastoprim weighing scale, (220 g, 0.01 g, external calibration)

- RT5 Multi-Magnetic Stirrer with Heating, IKA

- Thermohygrometer Testo 625

- SuperVario-N milk centrifuge (Germany)

Paper sacks

Paper sacks KH PACK® tartlet paper

KH PACK® tartlet paper Korreks for desserts

Korreks for desserts Ice cream chopsticks

Ice cream chopsticks Salad dressings

Salad dressings Laminating paper KH PACK®

Laminating paper KH PACK®- Backed Foil

- Grease and barrier paper KH PACK®

- Siliconized paper for hygiene products

- GableTop aseptic packaging

- The paper packing fastened anticorrosive UNIK 14-70 THAT 5453-003-05773103-2005

- KH PACK® Straight Packing Paper

- Skiving and Hemming Technology

- Plastic packaging for cakes and pastries

- Korreks for confectionery

Pepsin whey pork

Pepsin whey pork Petri dish 90 mm

Petri dish 90 mm Ice cream sticks (round)

Ice cream sticks (round) Cartons for milk and dairy products

Cartons for milk and dairy products Ice cream sticks Standard 93

Ice cream sticks Standard 93 Wafer cup and cone

Wafer cup and cone- General purpose environment of SPC "Biocompass-S" (Uglich)

- Auxiliaries for sugar products

- Ice cream sticks Magnum (curly)

- Ice cream sticks Standard 114

- Ice cream sticks (with logo)

- J-Bottom technology

Mug for milking the first streams of milk.

Mug for milking the first streams of milk. Pre-milking udder cleaner (20 l)

Pre-milking udder cleaner (20 l) Fall with a loop for cattle

Fall with a loop for cattle Drencher for feeding calves with a rigid probe

Drencher for feeding calves with a rigid probe Latex gloves (long cuff with roller), (color blue, pack of 50 pieces)

Latex gloves (long cuff with roller), (color blue, pack of 50 pieces) Milk filters - primary cleaning

Milk filters - primary cleaning- Pump for artificial ventilation of the lungs

- Antibryk

- Plastic syringe 150ml

- Foam cup for udder treatment

- Gas tailing cutter

- Spatula for mastitis test (Shalm's test)

- Apron and armlets

- Reusable plastic syringe

- Acid detergent (20l / 24kg)

Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate

Coliform Count Plate (catalog number LR1002) MicroFast® Coliform Count Plate MicroFast® Environmental Listeria Count Plate

MicroFast® Environmental Listeria Count Plate MicroFast® Salmonella Count Plate (SAL), for the determination of Salmonella in food and environmental samples (Catalog #LR1006)

MicroFast® Salmonella Count Plate (SAL), for the determination of Salmonella in food and environmental samples (Catalog #LR1006) MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011)

MicroFast® Enterobacteriaceae Count Plate (cat. no. LR1011) MicroFast® Bacillus cereus Count Plate (catalog number LR1010)

MicroFast® Bacillus cereus Count Plate (catalog number LR1010) Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate

Substrate for determining the number of staphylococci (Catalog number LR1005) MicroFast® Staphyloccocus aureus Count Plate- MicroFast® Microbiological Substrates

- MicroFast® Lactic Acid Bacteria Count Plate (Part Number LR1312)

- MicroFast® Coliform & E.coli Count Plate

- Yeast & Mold Count Plate (cat. no. LR1003) MicroFast® Yeast & Mold Count Plate

- Substrate for determining QMAFAnM (catalog number LR1001)

- MicroFast® Staphyloccocus aureus Confirmation Plate Staph.aureus Confirmation Plate (cat. no. LR1005Q)

- Substrate for accelerated determination of QMAFAnM, (catalog number LR1321)

Первые в центральном регионе. Узнали, какой каравай зерновых собрали в этом сезоне в ОАО "Гастелловское" 03.10.2025

Первые в центральном регионе. Узнали, какой каравай зерновых собрали в этом сезоне в ОАО "Гастелловское" 03.10.2025 Калининградская область заинтересована в обмене опытом с Беларусью в мелиорации и закупке техники01.10.2025

Калининградская область заинтересована в обмене опытом с Беларусью в мелиорации и закупке техники01.10.2025 Belarusian exports of dry milk products to Myanmar quadrupled in the first half of the year. 01.10.2025

Belarusian exports of dry milk products to Myanmar quadrupled in the first half of the year. 01.10.2025- В ОАО "Агро-Колядичи" умеют получать завидные урожаи30.09.2025

- "Россь" не рассчитывает на авось30.09.2025

- Куда инвестирует бизнес? Узнали, какой город в Беларуси выбрал для вложений производитель протеиновых батончиков30.09.2025

- БУТБ обеспечит платформу для взаимодействия белорусского и индонезийского бизнеса28.09.2025

- В ОАО "Святая Воля" в Ивацевичском районе за полгода выручка на каждого работника составила Br98 тыс.27.09.2025

- Газ на пятилетку, вторая АЭС, защита общего рынка и Украина. Подробности переговоров Лукашенко и Путина27.09.2025

- Record-breaking animals are being raised at the Ross breeding farm in the Volkovysk district.26.09.2025

- Шашлычок, мясные шарики, гуляш, борщ. Посмотрели, чем кормят детей в школе и сколько это стоит26.09.2025

- At OJSC "Svyataya Volya" in the Ivatsevichi district, revenue per employee over the past six months amounted to Br98 thousand.26.09.2025

- OAO Ostromechevo invested over $18 million in livestock development.26.09.2025

- Farmers at Rogoznyansky JSC in Zhabinka District increased their grain yields by more than a third.25.09.2025

- В ОАО "Агро-Колядичи" самой урожайной культурой оказался ячмень25.09.2025

- Алтайский край заинтересован в развитии биржевой торговли с Беларусью25.09.2025

В Алтайском крае наблюдается уменьшение поголовья скота при росте молочного производства03.10.2025

В Алтайском крае наблюдается уменьшение поголовья скота при росте молочного производства03.10.2025 Красноярский край выделяет 60 миллионов рублей на поддержку аграриев для покупки племенных животных03.10.2025

Красноярский край выделяет 60 миллионов рублей на поддержку аграриев для покупки племенных животных03.10.2025 Чили — второй по величине рынок бразильской свинины03.10.2025

Чили — второй по величине рынок бразильской свинины03.10.2025- Испания остаётся ведущим производителем комбикормов в Европе03.10.2025

- В сентябре Россельхознадзор проконтролировал 82 тысячи тонн продукции животноводства в Московском регионе03.10.2025

- Рост сельхозпроизводства в августе: увеличение на 6,1% по сравнению с июлем03.10.2025

- Новый федеральный проект по поддержке малого агробизнеса: инвестиции и развитие сельских территорий03.10.2025

- Снижение объемов реализации сельхозпродукции в России за 2025 год: изменения и тенденции03.10.2025

- ПРОДО Омский Бекон запускает новый участок опороса с высокой производительностью03.10.2025

- Ростовская область экспортировала в Грузию новую партию свиней на убой03.10.2025

- Революция в производстве мяса птицы: Семикаракорский комбинат увеличил объемы на 25%03.10.2025

- Производитель тушенки в Бурятии повторно оштрафован за нарушения03.10.2025

- Miratorg's 15th Anniversary: The Meat Retail Leader Celebrates Its Anniversary03.10.2025

- Тюменская сеть магазинов «Светофор» оштрафована на 700 тысяч рублей за продажу мяса с антибиотиками02.10.2025

- В продукции ООО «Мерилен» в Хабаровске обнаружены кишечные палочки и превышение норм02.10.2025

- В Калужской области разоблачены торговцы фальсификатом мяса и рыбы02.10.2025

10 reasons to take a deposit04.05.2025

10 reasons to take a deposit04.05.2025 Губернатор назвал меры по борьбе с топливным кризисом в Хабаровском крае02.10.2025

Губернатор назвал меры по борьбе с топливным кризисом в Хабаровском крае02.10.2025 Bloomberg узнал о плане G7 значительно ужесточить санкции против России02.10.2025

Bloomberg узнал о плане G7 значительно ужесточить санкции против России02.10.2025- G7 заявила о проработке использования всей суммы российских активов02.10.2025

- Фон дер Ляйен заявила о смене подхода к санкциям против России02.10.2025

- США раскрыли долю поставляемого из России топлива для ядерных реакторов01.10.2025

- Евросоюз частично восстановит санкции против Ирана30.09.2025

- Yle узнал, что ЕС не планирует вносить российский никель в список санкций28.09.2025

- Иран сообщил о предложенной Штатами отсрочке санкций в обмен на уран28.09.2025

- Кремль отреагировал на планы ЕК изменить механизм продления санкций27.09.2025

- МИД ввел санкции против Британии и назвал ее меры «тришкиным кафтаном»27.09.2025

- Politico has learned that the European Commission has proposed changing the sanctions extension mechanism.26.09.2025

- В Венгрии подсчитали убытки из-за отказа от российского газа26.09.2025

- The FT reported on the German cellist's "too bold" ties to Russia.26.09.2025

- Bloomberg назвал условие Индии для отказа от российской нефти26.09.2025

- EUObserver узнал о нежелании ЕС закрываться от российских туристов25.09.2025

В Британии предупредили о риске для миллионов из-за супербактерий06.01.2025

В Британии предупредили о риске для миллионов из-за супербактерий06.01.2025 Moscow court sides with Indian company in dispute with Health Ministry26.11.2024

Moscow court sides with Indian company in dispute with Health Ministry26.11.2024 Scientists estimate increase in mortality due to drug-resistant bacteria29.10.2024

Scientists estimate increase in mortality due to drug-resistant bacteria29.10.2024- Antibiotics for livestock and pesticides found in poisoned family's home29.10.2024

- Izvestia reported on the shortage of widely used antibiotics in Russia29.10.2024

- The Ministry of Health called data on the shortage of antibiotics unreliable29.10.2024

- Scientists warn of threat of return to pre-penicillin times29.10.2024

- The Ministry of Health explained how attitudes towards antibiotics changed during the pandemic07.05.2024

- WHO explains the risks of taking antibiotics "just in case"06.05.2024

- Doctors warn of bad practices after government decision on antibiotics25.04.2024

- The Ministry of Health removed antibiotics and hormones from the standard treatment of ARVI25.04.2024

- Antibiotics in oil: myth or reality?06.03.2024

- Antibiotics in sour cream: myth or reality?05.03.2024

- Antibiotics in goat milk: effects, problems and control measures16.02.2024

- The Japanese will stop producing the popular antibiotic vilprafen in Russia23.12.2023

- Antibiotics in Milk21.12.2023

Antibiotics in pollock25.02.2024

Antibiotics in pollock25.02.2024 Antibiotics in herring: myth or reality?12.02.2024

Antibiotics in herring: myth or reality?12.02.2024 Antibiotics in perch10.02.2024

Antibiotics in perch10.02.2024- Antibiotics in sprat: facts and myths10.02.2024

- Antibiotics in tuna: an important health and environmental issue09.02.2024

- Antibiotics in meat30.01.2024

- Antibiotics in chebureks: myth or reality?29.01.2024

- Antibiotics in cutlets: problem or myth?18.01.2024

- Antibiotics in Chicken: Where Are the Highest Concentrations?17.01.2024

- Antibiotics in carp17.01.2024

- Where Are More Antibiotics in Chicken: Reality and Cautions16.01.2024

- Antibiotics in Salmon: Safety and Product Quality16.01.2024

- Antibiotics in Turkey15.01.2024

- Antibiotics in Sal: Reality and Safety Issues15.01.2024

- Antibiotics in Fried Dumplings: Facts, Risks and How to Stay Safe15.01.2024

- Antibiotics in sausages14.01.2024

Antibiotics in Coffee: Myths and Reality03.05.2025

Antibiotics in Coffee: Myths and Reality03.05.2025 Forged forks: 10 interesting facts16.05.2024

Forged forks: 10 interesting facts16.05.2024 Swimming pool and weight loss: 10 interesting facts10.03.2024

Swimming pool and weight loss: 10 interesting facts10.03.2024- Tests for antibiotics in milk - 10 interesting facts07.03.2024

- Cleaning the kettle from scale, 10 interesting facts...06.03.2024

- Antibiotics in beer: 10 interesting facts04.03.2024

- Wild boar, how to survive...01.03.2024

- Purulent mastitis, 10 interesting facts27.02.2024

- Lemon and alcohol: 10 interesting facts25.02.2024

- Mint - 10 interesting facts25.02.2024

- Wild boar, 10 interesting facts20.02.2024

- Wild boar and domestic pig: comparison and advantages20.02.2024

- Cottage cheese, 10 interesting facts20.02.2024

- 10 Interesting Facts About Milk19.02.2024

- How to Clean a Toilet - 10 Interesting Facts (Acid vs Alkaline)18.02.2024

- Goat's milk: 10 interesting facts16.02.2024

Dicroceliosis in cattle09.03.2024

Dicroceliosis in cattle09.03.2024 Demodicosis in cattle01.03.2024

Demodicosis in cattle01.03.2024 Purulent mastitis of cattle27.02.2024

Purulent mastitis of cattle27.02.2024- Hypodermatosis in cattle20.02.2024

- Hemonchoz in cattle11.02.2024

- Bursitis in cattle30.01.2024

- Brucellosis in cattle29.01.2024

- Bronchopneumonia in calves27.01.2024

- Bronchitis in cattle26.01.2024

- Mortellaro disease in cattle24.01.2024

- White muscle disease in cattle23.01.2024

- Babesiosis in cattle22.01.2024

- Cattle acidosis20.01.2024

- Arthritis in cattle20.01.2024

- Anaplasmosis in cattle18.01.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024

Antibiotics for coughs: when they are needed and when they are not11.02.2024 Ответственность для бесправников планируют дифференцировать в зависимости от их категории03.10.2025

Ответственность для бесправников планируют дифференцировать в зависимости от их категории03.10.2025 О самых распространенных причинах пожаров рассказали в МЧС03.10.2025

О самых распространенных причинах пожаров рассказали в МЧС03.10.2025- Из-за пьяного бесправника погибли два человека. Следователи раскрыли подробности ДТП в Браславском районе02.10.2025

- В Бресте нетрезвая женщина попала под машину02.10.2025

- "Cardboard Superpower." What is Poland prepared to take into 2026?02.10.2025

- A drunk mechanic hit a Gomel resident with his own car. The Investigative Committee has revealed details of the case.01.10.2025

- Хулиганство в интернете и реальной жизни. Верховный Суд обновил разъяснения для правоприменителей30.09.2025

- Compensation for moral damages, 4 years in prison. The perpetrator of a fatal accident near Gomel has been sentenced.30.09.2025

- She stabbed her partner in the back. The Investigative Committee has revealed details of the criminal case in Novopolotsk.27.09.2025

- За смену - десятки вызовов. Сотрудники ППС о спецзаданиях и необычных случаях 27.09.2025

- Как победить "осенний синдром"? Очень простые советы для хорошего самочувствия27.09.2025

- В Беларуси перенесены сроки введения прослеживаемости и маркировки товаров 26.09.2025

- Что является одной из основных причин травмирования на производстве, рассказали в ФПБ25.09.2025

- Минчанин лишился крупной суммы и золотого слитка после неудачного свидания 24.09.2025

- В центре внимания пешеходы и велосипедисты. ГАИ усилила контроль за соблюдением ПДД в Минском районе 24.09.2025

Persons

Our Partners

Top 10

Our Test - Pioneer Tests

- Express tests for determining the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins in milk, whey

- TEST KIT for determination of inhibitory agents PIONEERPRODUKT® DASH-TEST, WC0040

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0586 - Antibiotic tests 5 in 1 / Rapid tests for determining the residual amount of β-lactams, tetracyclines and cephalexin in milk, whey

- PIONEER MEIZHENG BIO-TECH (5 in1) JC0871/ Rapid tests for the determination of the residual amount of β-lactams, tetracyclines, chloramphenicol, streptomycins, ceftiofur in milk, whey.

- PIONEER MEIZHENG BIO-TECH (5 in1) JC1165 / Rapid tests for the determination of the residual amount of halofuginone, flavomycin, novobiocin, flunixin, dexamethasone / prednisolone in milk, whey